Viikko vierähtää nopeasti ja viikonlopun markkinakatsaus on taas täällä! Kuten viikon otsikko vihjaa, dipit voivat olla harkinnan arvoisia lähiaikoina. Viime päivien vahvuuden perusteella on täysin mahdollista, että syyskuun lopussa nähdään parin prosentin korjaus. Edessä on myös iso viikko: Fedin FOMC keskiviikkona, VIX-optioiden erääntyminen keskiviikkona sekä Q3:n optioiden erääntyminen (triple witching) perjantaina! Perjantain erääntymästä näyttää tulevan kaikkien aikojen suurin, ja sen jälkeen markkina voi jälleen liikkua vapaammin ja heilunta kasvaa. Dippien ostaja toivoo luonnollisesti −3–5 % korjausta – se on täysin mahdollinen skenaario, mutta markkinan positiivisen gamman pienentyminen voi yhtä lailla merkitä uutta ylöspäin suuntautuvaa voimaa.

Riippumatta siitä, tuleeko parin prosentin lasku vai ei seuraavien kahden viikon aikana, emme todennäköisesti ole tehneet suurta pitkän aikavälin huippua Yhdysvaltain pörsseissä tällä viikolla! Tätä tukee AAII Sentiment Survey: peräti 49,5 % vastaajista on bearish (odottaa S&P 500:n laskevan 6 kuukauden tähtäimellä). Vain 28 % on bullish ja uskoo nousuun 6 kk:n aikana. On sinänsä hämmästyttävää, että sentimentti ei ole vahvempi ATH-tasoilla; 49,5 % karhuja on historiallisesti ollut “contrarian buy” – erityisesti niille, joiden horisontti on kuukausi tai pidempi.

Alla oleva kuva näyttää S&P 500:n viikkokaavion suhteessa AAII:n karhujen osuuteen. 49,5 % ja sitä korkeammat tasot on ympyröity vihreällä, ja 20 % karhuosuus on merkitty punaisella. Jos pörssi tekisi ison huipun tällä viikolla, se olisi ensimmäinen kerta koskaan, kun näin tapahtuu enemmistön ollessa negatiivinen. Huiput syntyvät tyypillisesti korkean optimismin vallitessa, kun karhuja on noin 20 %. Olemme kaukana siitä, ja toimituksessa pidämme edelleen todennäköisenä, että näemme S&P 500:n 7200–7500 jo tänä vuonna! Jos tuo liike toteutuu, aiomme olla selvästi varovaisempia USA:n osakkeiden suhteen siinä vaiheessa, sillä euforia on todennäköisesti samaan aikaan huipussaan. Siellä emme siis vielä ole – hullua kyllä!

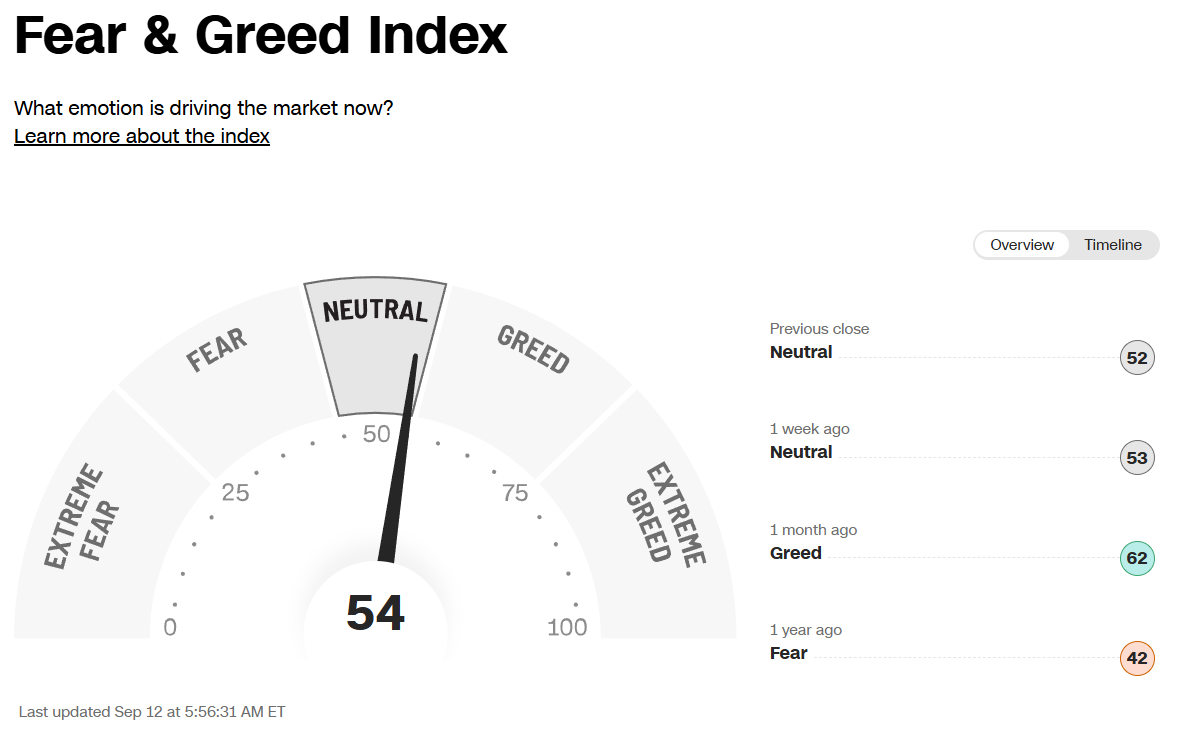

CNN:n Fear & Greed -indeksi on tällä viikolla neutraalilla tasolla. Tuskin olisi odottanut näkevänsä tätä samaan aikaan, kun S&P 500 on kaikkien aikojen huipussa tasolla 6585! Tämä tarkoittaa myös, että mahdollinen korjaus seuraavien 1–2 viikon aikana voi nopeasti laskea F&G-indeksin Fear– tai jopa Extreme Fear -alueelle liikkeen voimakkuudesta riippuen. Siinä tapauksessa Q4:lle voisi avautua houkutteleva asetelma.

BofA:n tulevaisuuspohdintoja

Luin tällä viikolla alla esitetyt Michael Hartnettin kiinnostavat ajatukset, joissa hän vetää rinnastuksia 1970-lukuun, käsittelee Yield Curve Controlia (YCC) ja esittää tulevaisuusskenaarionsa. Myös me Marketmaten toimituksessa olemme todenneet, että YCC on pitkälti vain ajan kysymys (tässä). Jos Mr. Hartnett ei ole entuudestaan tuttu, hän toimii Chief Investment Strategistina BofA Merrill Lynch Global Researchissa. Uskon, että moni teistä lukijoista pitää alla olevan katsauksen mielenkiintoisena, ja ajanpuutteen vuoksi välitän artikkelin englanniksi.

One week ago, BofA’s Michael Hartnett shocked some of his readers (and clients), when he observed that if this bull market follows the path of history, then “history says S&P 500 peaks at 9914 in Sep 2027” because the “average gain in 14 US equity bull markets in past 100 years is 177% in 59 months.” This, of course, assumes there is no crash before then. Or maybe even assuming there is, because the big question investors are starting to ponder is what will the Fed and other central banks do when the bond market finally cracks, and the answer proposed by Hartnett is the one we have been offering for years, namely Yield Curve Control… and the end of free bond markets.

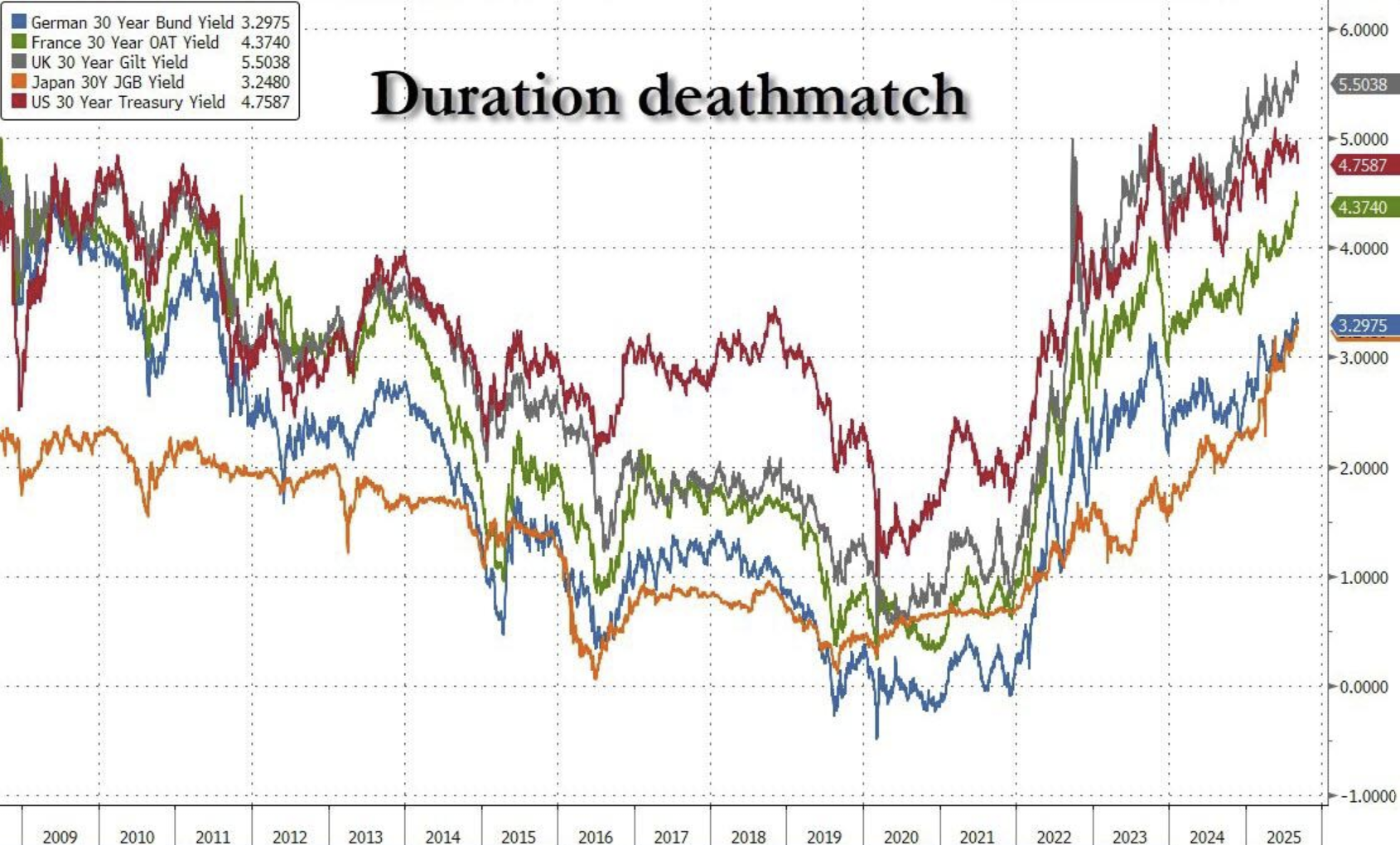

As Hartnett writes in his latest Flow Show note titled “Invisible Hand to Visible Fist”, the UK long bond yield 5.6% (highest since ‘98), France 4.4% (highest since ‘09), Japan 3.2% (highest since ’99), meanwhile US 30Y tests 5%.

Amid this bond market panic, stocks are chilling as they discount central bank PKO (Price-Keeping Operations) or policies to prevent disorderly jump in debt costs, all of which are very familiar to stock bulls (they are YCC, QE, and Operation Twist); as such, Hartnett again echoes what we have been saying all along urging clients to go “long gold into YCC & say lower yields (PKO + Fed credible rate cuts) = broadening of stock market via bond sensitives (biotech, REITs, small cap).“

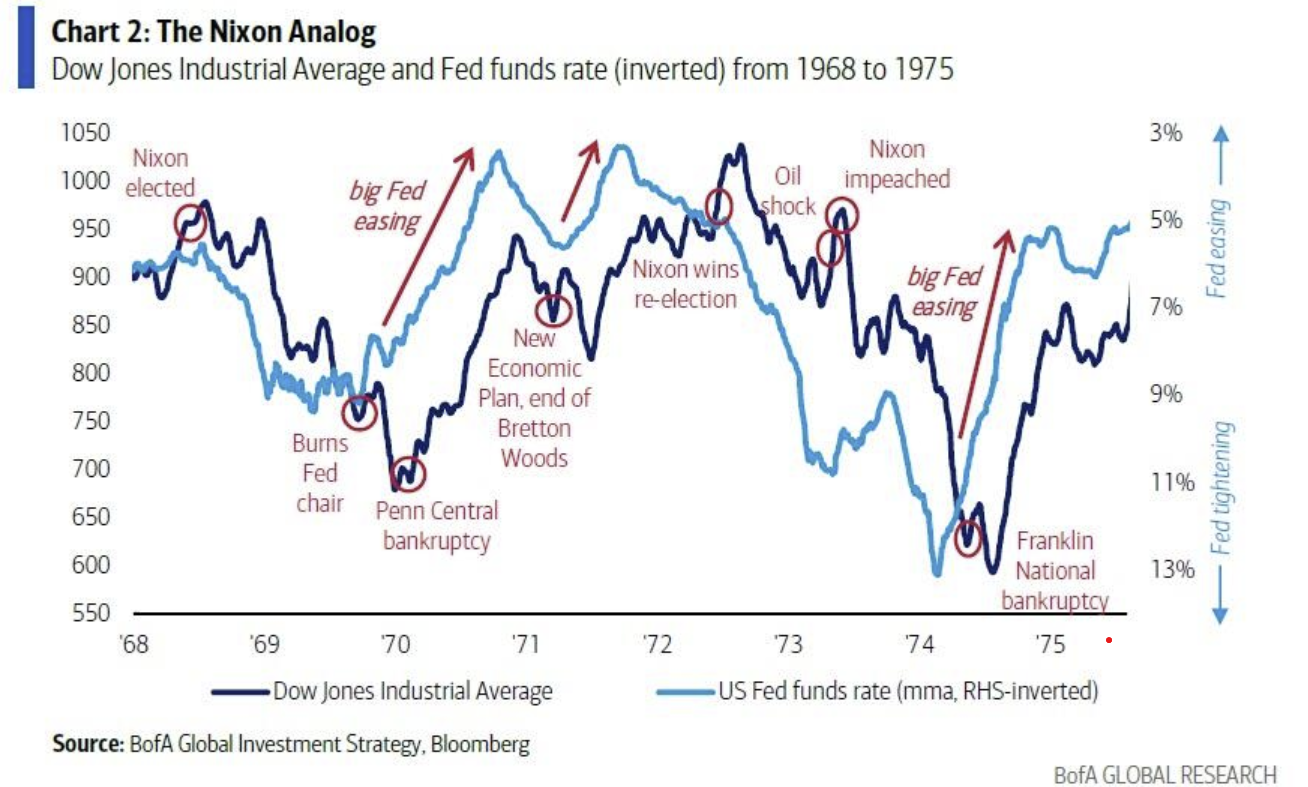

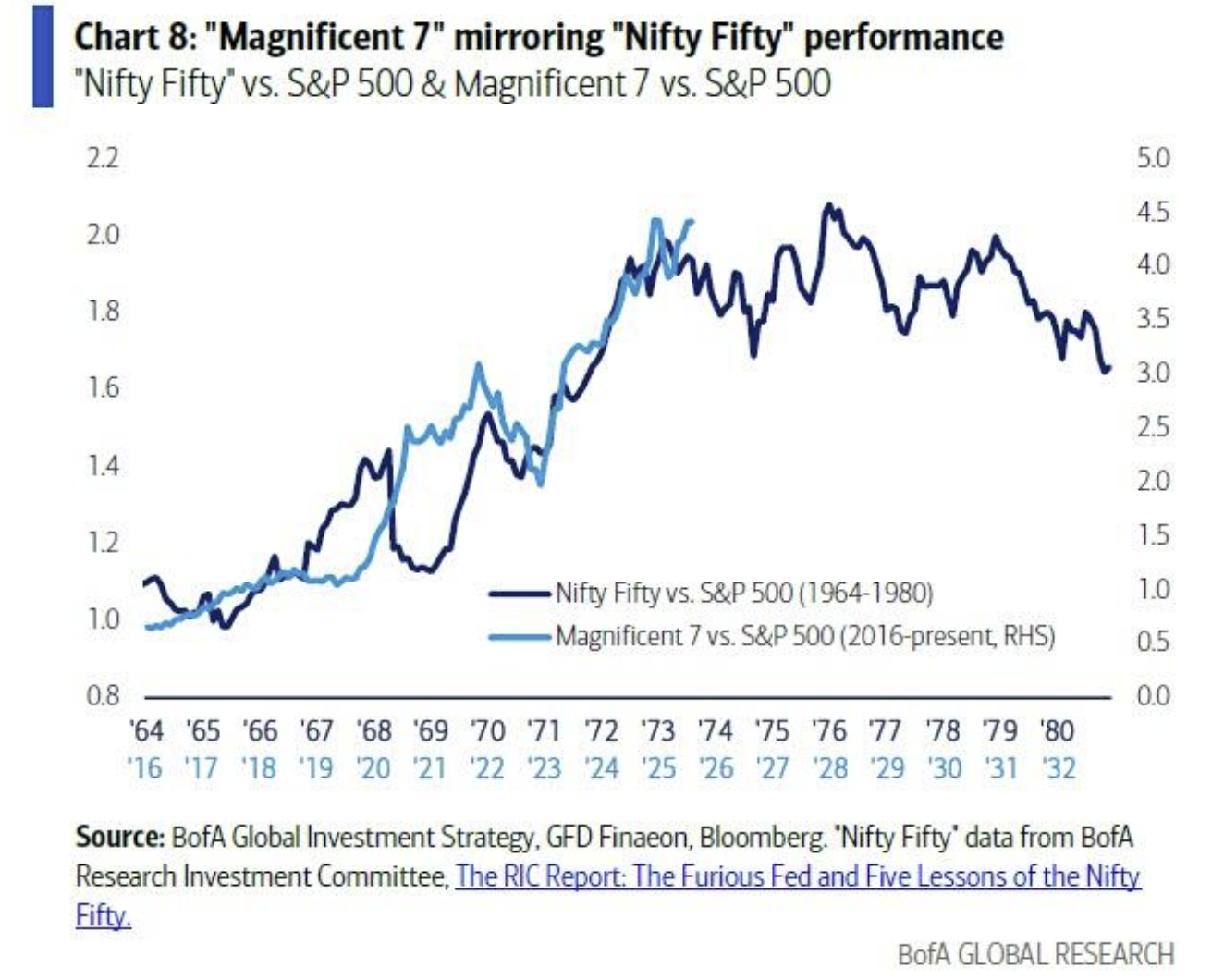

There is another reason why Hartnett is betting it all on YCC: to him, the “Biggest Picture” is most analogous to the Nixon ‘70-‘74 period: like then, we now also have political pressure on the Fed and FX, both meant to ease financial conditions for a pre-election boom = which stated simply means risk-on, and Mag7-on (it was the Nifty 50 back then), and UST yields lower until the 2nd wave inflation arrives some time in 2026; Of course, the Nixon analog also says that ‘25/’26 “price controls” will be needed to stop inflation. Which to Hartnett means go long sectors that “outpace China”, and short sectors that “whip inflation.”

Or, said otherwise, Hartnett is Long Gold, Bonds, Breadth into YCC. Here are the details why:

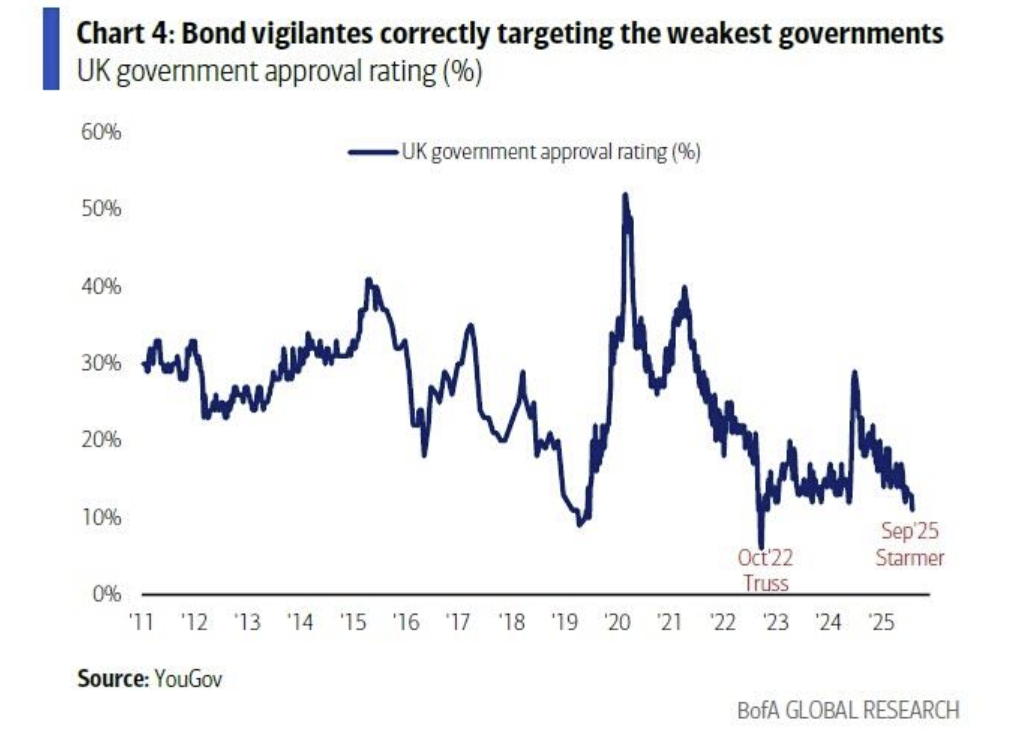

- Long bond yields: UK 5.6% (highest since ‘98), France 4.4% (highest since ‘09), Japan 3.2% (highest since ’99), US tests 5%; all as bond vigilantes correctly targeting most weak, unpopular governments… UK PM Starmer approval rating 11% (lowest since Truss – Chart 4), France Macron approval 19% (lowest since ‘16), Japan Liberal Democratic Party approval 24% (lowest since ‘12), and bond investors discounting a future of populist policies as “incumbents” ousted from office in 32 of 43 elections past 18 months;

- But no contagion into risk assets: historically, when bond yields up, credit spreads up, and bank stocks down, we have seen >10% correction; today… HY CDX 320bps (not >400bps), Japan/France/UK bank stocks stable

- Hartnett says next big bond yield move down not up: as ever, policymakers likely to respond to disorderly moves up in cost of government debt bond via PKO (Price-Keeping Operations) policy measures e.g., Operation Twist, QE, Yield Curve Control (forecast by 54% of investors in BofA Global FMS – Chart 12 in August Global Fund Manager Survey), revaluation of gold reserves, and so on.

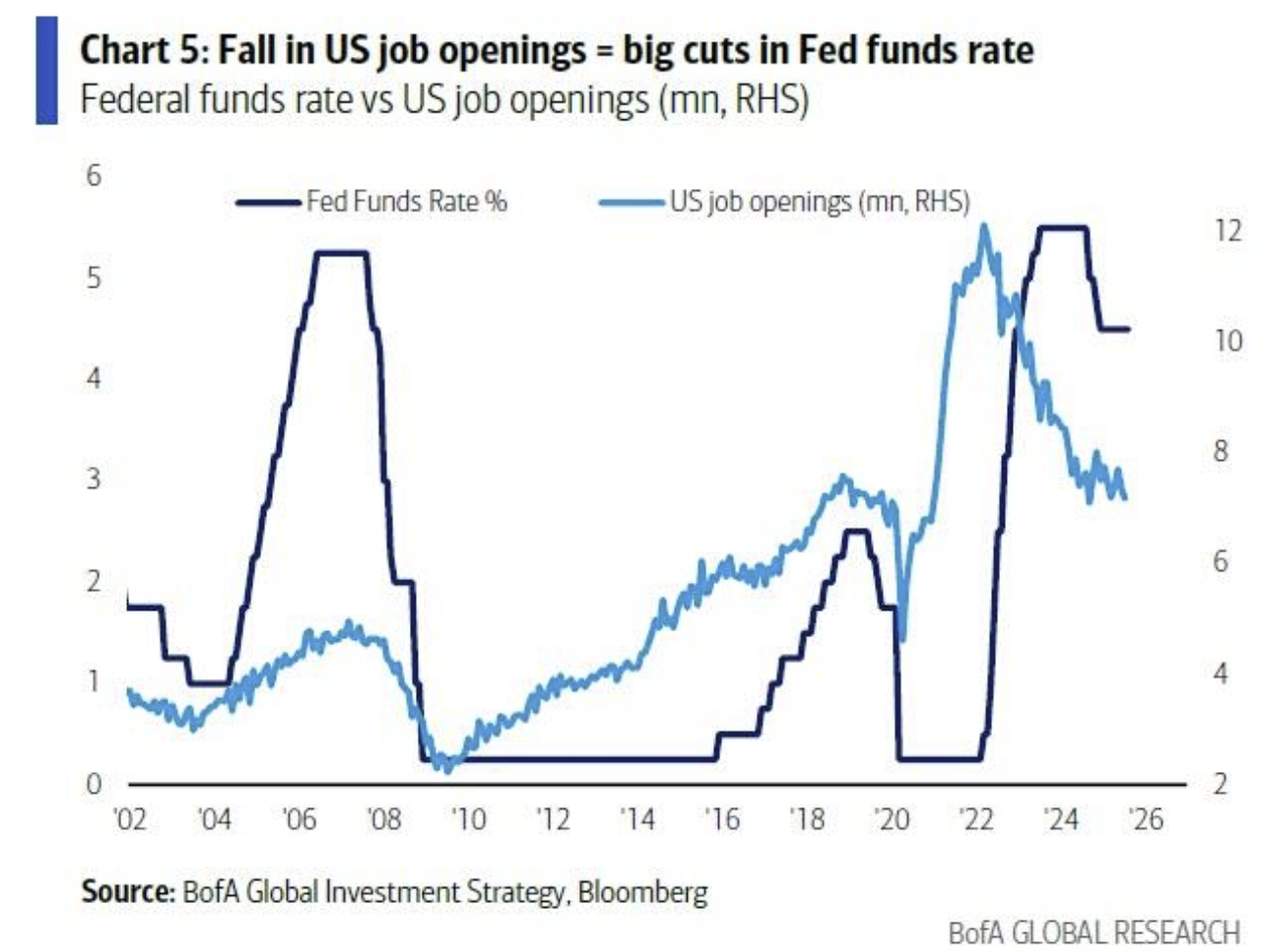

- Fed under great political pressure to cut (see Nixon analog) but US data weakening sufficiently to allow Fed to cut credibly: July construction spending down 2.8% YoY (despite AI data center boom = 6% of total $2.1tn) and rate-sensitive recessionary right now…

- … US house prices down in past 4 months, JOLTS labor market data consistent with lower Fed funds, AI jobs disruption starting (graduate unemployment rate up 4% to 8% past 18 months), so…

- …absent 2nd wave inflation and/or negative payrolls that augers jump in US deficit from 7% to >10% of GDP/debt default worries (we missed it by just 22k), Hartnet says US bond yields heading toward 4% not 6%, and this supportive of equity broadening via structurally unloved long duration equity sectors such as small cap, REITs, biotech. More improtantly, Hartnett remains of the view “long gold, crypto, short US dollar until US commits to YCC.“

The BofA strategist next takes us through the 1970s “Nixon analog” in “Booms, Busts & Visible Fists”

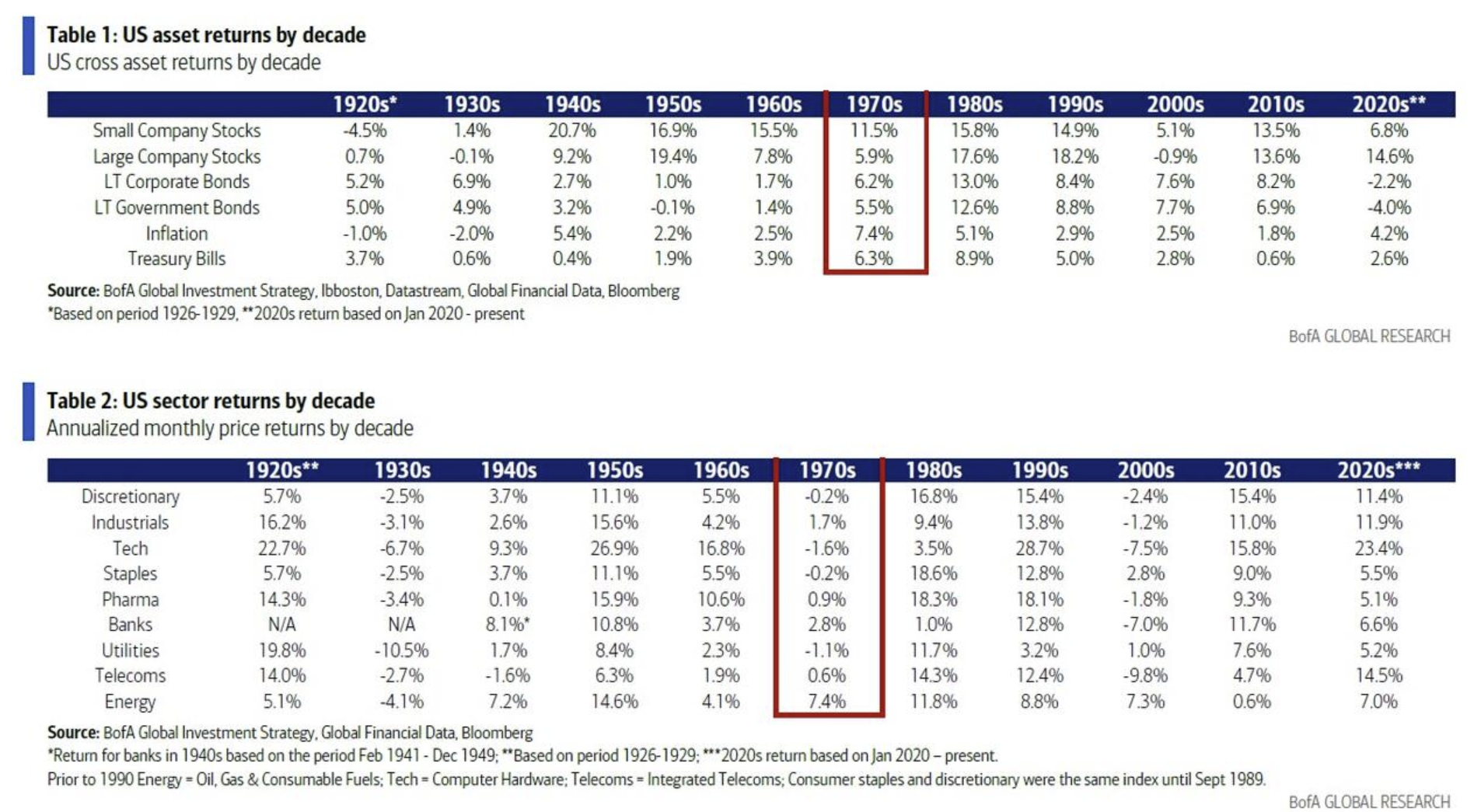

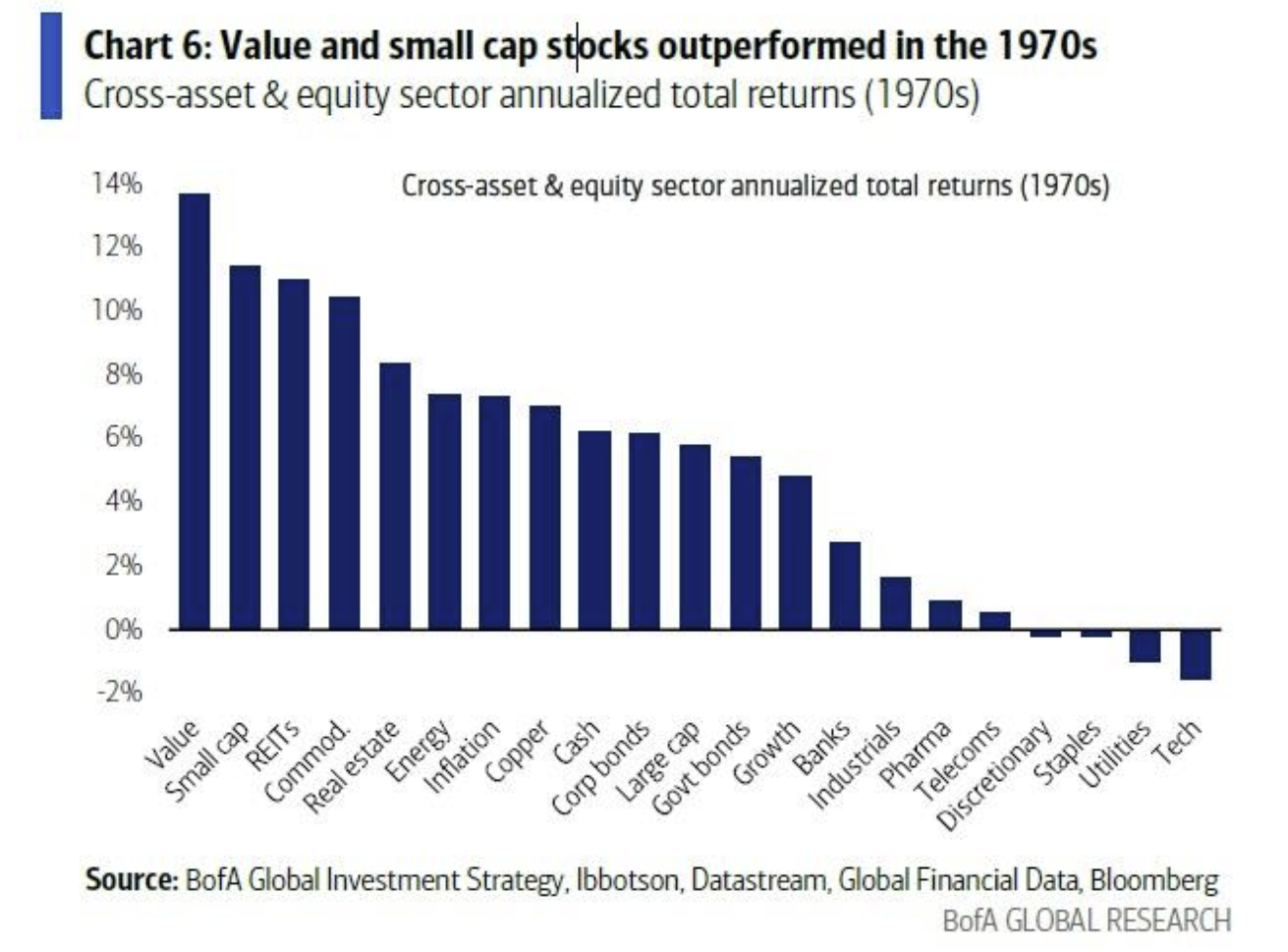

- The Nixon 1970s are the most obvious analog for investors deciding how to position for policy volatility, central bank tolerance of higher inflation, dollar debasement, and so on; 1970s followed long secular bond and equity bull markets of 1950s & 1960s which were disrupted by a boom & bust decade of protracted inflation, monetary instability, large budget deficits triggering events (IMF bailout of UK in 1976, New York City’s near bankruptcy in 1975), wage and price controls, two oil shocks (1973 & 1979), end of Vietnam War, Watergate scandal, and so on; in the 1970s as a whole there were multiple inflection points for interest rates and risk assets, broadly both stock and bond markets traded in big, fat ranges, and the ultimate winners over the 10 year period were small cap, value stocks, commodities, real estate)

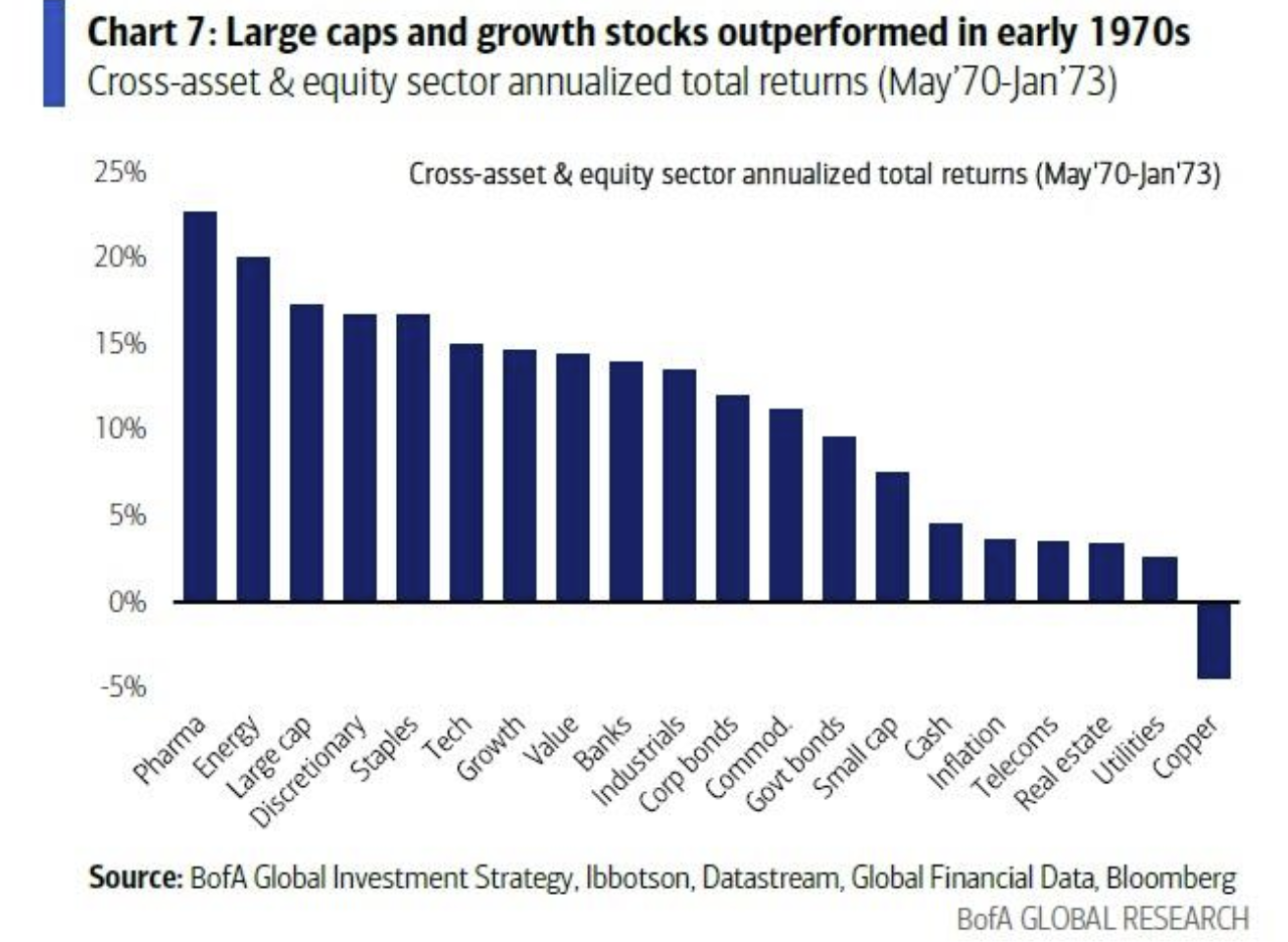

…though crucial for today to note equity leadership in first half of 1970s was dominated by big cap, margin rich, cash rich Nifty 50 stocks.

- Investors today looking to position for policy volatility, central bank tolerance of higher inflation, dollar debasement need to zoom in on 1969-73 Nixon 1st term of geopolitical realignment (end of Vietnam War, Nixon visits USSR & China), trade war (Nixon tariffs on Japan), pro-cyclical, shock therapy fiscal & monetary policies, US dollar debasement (end of Bretton Woods), Fed debasement (Nixon replacement of Martin with Burns) & political subservience; policy & markets; after short 1969 recession, massive easing of financial conditions in 1970 to 1972 (Fed funds 9% to 3%, US Treasuries 8% to 5%, US dollar -10%) to create pre-election “boom” coupled with aggressive price & wage controls to drive inflation down from 6% in Dec’69 to <3% in ‘72; equity markets boomed (up >60%) led by “Nifty Fifty”, growth stocks, energy & consumer sectors; note one difference today is starting point of equity valuations way higher than early ‘70s (16x trailing vs 27x today).

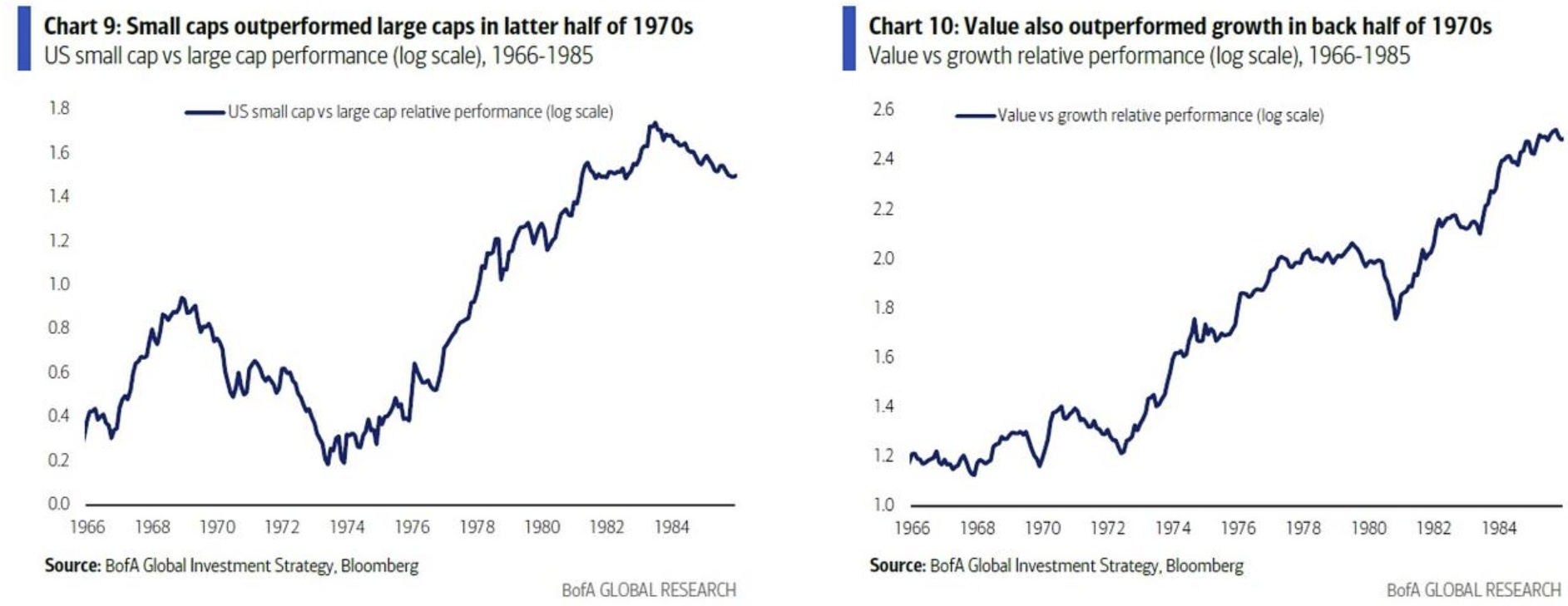

- Early 1970s boom was followed by big bust in ‘73/’74 as boom caused inflation to break loose (up from 3% to 12% by end-’74), “price controls” failed, Fed forced to hike rates aggressively (6% in ’73 to 13% in ’74), which with ’73 oil shock caused recession; stocks fell 45% from Jan’73 to Dec’74, yields rose from 6% in ’73 to >8% in Sep’74; deep recession and bust caused end of Nifty 50 and new equity leadership in H2’70s of small caps>large caps and value stocks>growth stocks.

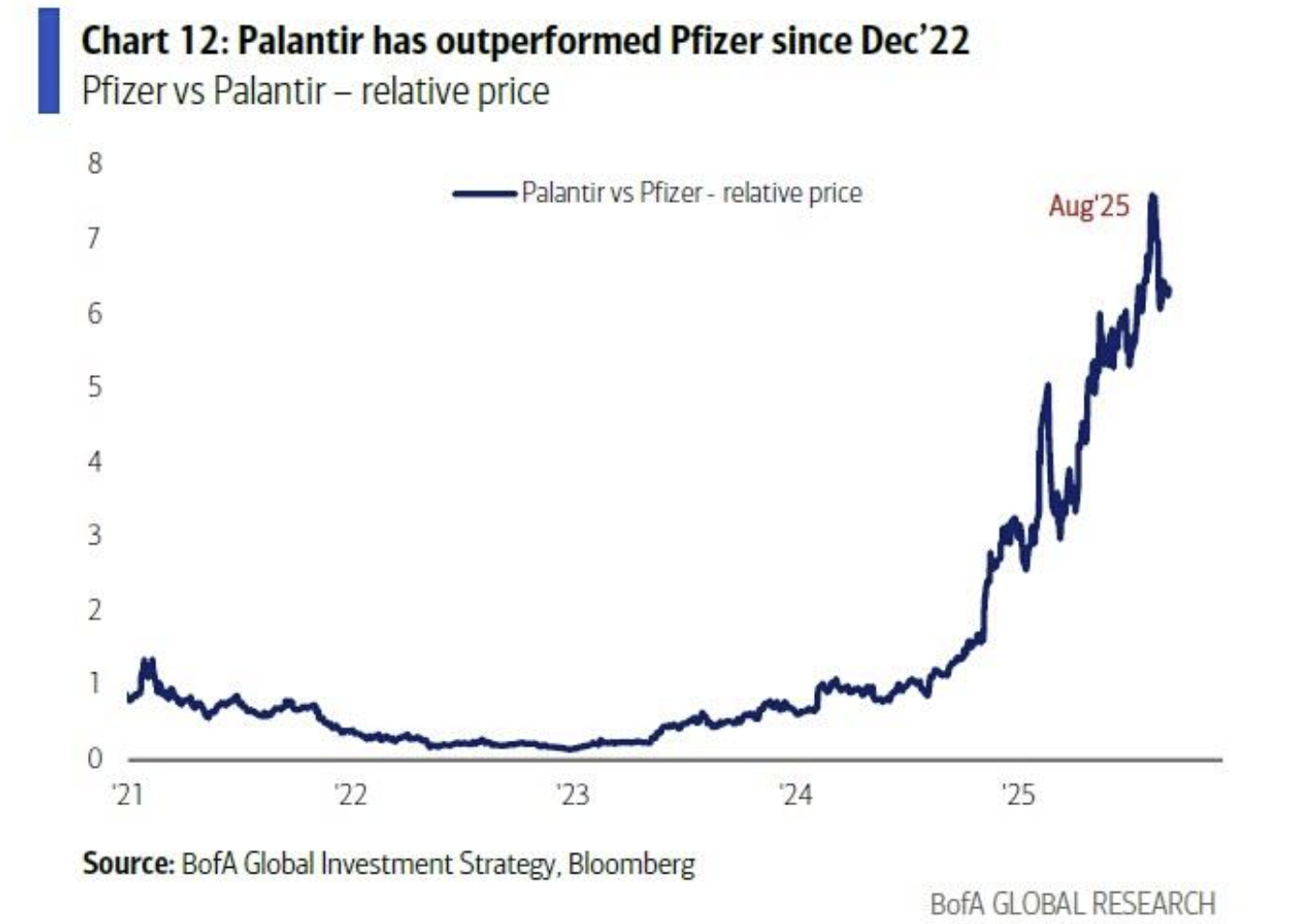

- Invisible hand to visible fist: while no explicit Trump price controls announced in 2025, US government intervention in economy and markets for political purposes very much on the rise; Trump likely knows that 2nd wave inflation would be politically unpopular heading into mid-term election, hence subtle moves to control prices, boost supply in energy (“drill, baby, drill” deregulation, Ukraine peace efforts – energy stocks -3% since election), healthcare (executive order to lower US drug prices to “Most-Favored-Nation” levels – healthcare -8% since election), housing (“National Housing Emergency” to improve housing affordability via new supply – homebuilders -2% since election); market continues to play Trump politics via short sectors that “whip inflation”; next most vulnerable is utilities (Trump vow to halve electricity prices within 12 months, US Energy Secretary “most worried about” AI-driven soaring electricity prices, ZeroHedge noting that those same soaring electricity prices will be all anyone talks about soon), and long sectors that “outpace China” to gain leverage over China and favorable trade deal in 2026 (national security winners such as Big Tech/Magnificent 7, semiconductors, aerospace & defense (Palantir vs Pfizer); likely to continue so long as Trump approval rating remains >45, but could end poorly if approval rating falls below 40.

Hartnett concludes his latest weekly note with his “Zeitgeist” observations from his recent trip to Tokyo & Singapore:

- Japanese local investors Hartnett spoke with are less bearish JGBs than foreigners; cyclical deficit under control, BoJ is slowing raising rates, MoF happy to fuel debt worries to help resist political demands to cut consumption tax, and imminent LDP change of leadership expected to be risk positive (“Nikkei would be 60k if it were not for Japanese politics”); Japan locals more worried that potential combo of “behind-the-curve hiking BoJ” and “behind-the-curve cutting Fed” causing disorderly jump in (visibly cheap) Japanese yen (which Japanese investors are not hedged for); many Tokyo investors expect US ultimately to resort to YCC.

- In Tokyo very few questions on tariffs, Japanese happy to “pay to play” in the US (weak yen helps and “paying” largely via loan guarantees rather than meaningful FDI); Japanese investors would be surprised by an improvement in US-China relation; Japan locals less bullish Nikkei than foreigners but say Nikkei looks in good shape with themes of banks, content, defense; foreigners add Japan stock market jam-packed with cheap, under-researched global supply chain winners, and optimistic Japanese institutions will allocate from bonds to stocks; all happy owners of US stocks, buyers of China stocks.

- Singapore investors Hartnett met with see global tail risks as greatly reduced on Trump policy pivot to lower tariffs, taxes, rates; less bearish than European investors on US dollar, nervously long global equity barbell of US/China tech & Japan/Europe banks, see recession as only event that breaks risk assets; US stock and corporate bonds valuations mean not looking to add to US positions, many expect summer reticence of Asia exporters to raise prices of industrial goods in the US to end in coming months pushing US import costs higher, and growing concerns that AI capex burn story will become narrative in H1’26.

- Potential surprises voiced by Singapore investors: a China-India economic pact, a Xi-Trump trade deal exchanging China renminbi appreciation for lower US tariffs, China is quickly eroding US AI & chip superiority, 2026 credit events will be in crypto and private credit not government debt.

Näiden Bank of American näkemysten myötä päätämme tämän viikon katsauksen!

Kiitos kuluneesta viikosta ja mukavaa viikonloppua!

Ystävällisin terveisin

David & Team Marketmate